Sacha D. Gelfer

Published Papers

Data-Rich DSGE Model Forecasts of the Great Recession and its Recovery

Review of Economic Dynamics--Volume 32, April 2019, pp.18-41

I investigate the extent to which modern dynamic stochastic general equilibrium (DSGE) models can produce macroeconomic and labor market dynamics in response to a financial crisis that are consistent with the experience of the Great Recession. Using the methods of Boivin and Giannoni (2006) and Kryshko (2011), I estimate two DSGE models in a data-rich environment. The two models estimated in this paper include close variations of the Smets & Wouters (2003, 2007) New Keynesian model and the FRBNY (Del Negro et al. 2013) model that augments the Smets & Wouters model with a financial accelerator. I find the model with a financial accelerator that is estimated in a data-rich environment is able to significantly out-forecast modern DSGE models not estimated in a data-rich environment and the Survey of Professional Forecasters (SPF) in regard to core macroeconomic growth variables and many labor and financial metrics including the unemployment rate, total number of employees by sector and business loans.

The Effects of Professional Forecast Dissemination on Macroeconomic Volatility

Journal of Economic Behavior and Organization--Volume 170, February 2020, pp.131-156

This paper explores the role that professional forecast announcements can have on macroeconomic volatility. Bounded rational agents are used inside a medium scale dynamic stochastic general equilibrium (DSGE) model with financial frictions. Modeled agents must form expectations about endogenous variables by selecting between three simple linear forecasting specifications some of which contain the inclusion of a“professionally announced forecast of the economic variable. Historically calibrated simulations of the model show that the usage of the announced professional forecast by the agents in their adaptive learning forecast specifications can reduce the volatility in consumption, inflation and wages by as much as 26%, 23% and 22% respectively. However, if the professional forecast is not disseminated well to the agents or biased in its dissemination, agents will learn to ignore the announcement and macroeconomic volatility will increase. Further, the inclusion of very noisy professional forecast signals can result in “coordinated volatility cascades” where agents could reduce macroeconomic volatility by ignoring the professional forecast but choose not to because of its previous forecast performance.

Re-evaluating Okun’s Law: Why all recessions and recoveries are "different"

Economics Letters--Volume 196, November 2020, 109497

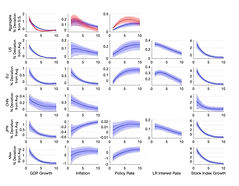

This paper explores the relationship between GDP growth, the unemployment rate and employment growth. Using a structural DSGE model and a data-rich estimation approach I am able to estimate the coefficients and correlations between GDP growth and unemployment rate changes, GDP growth and overall employment growth as well as GDP growth and employment growth by sector. I find historically equivalent estimates when I compare the simulated model with actual realized data. I am then able to look at the effect different types of economic shocks have on these estimates and I find that investment and finance shocks have larger effects on employment growth and the unemployment rate when compared to productivity and other supply-side shocks when the effect on GDP is controlled for. For example, the model suggests that a 1% decline in real GDP would result in an increase of the unemployment rate of 0.5% if it was caused by a financial or investment shock, however, it would only increase the unemployment rate by 0.15% if the 1% decline in real GDP was caused by a productivity shock.

Journal of Economic Dynamics and Control--Volume 129, August 2021, 104177

This paper examines the inferences and forecasting benefits that can be made when one incorporates a large quantity of economic time series into international structural macroeconomic models. I estimate a close variation of Adolfson et al. (2007, 2008) small open-economy dynamic stochastic general equilibrium (DSGE) model in a data- rich environment and evaluate its predictive performance of the Canadian macroeconomy. The data set I use in the paper includes Canadian, American, Asian and European macro-financial data. I compare the forecasting performance of the DSGE model estimated in a data-rich environment (DSGE-DFM) to the forecasts generated by the DSGE model under estimated in its traditional setting and forecasts generated by other reduce formed forecasting models. I find that an open-economy DSGE model estimated in a data-rich environment significantly out performs its regularly estimated DSGE counterpart and the DSGE-DFM forecasts that incorporate real-time data are similar or better to the Bank of Canada’s Staff Economic Projections for GDP, consumption, investment, and trade statistics. In addition, the DSGE-DFM model of this paper is useful in forecasting both the real and nominal exchange rate in the short and medium-term.

AEA Papers and Proceeding--Volume 112, May 2022, pp. 619-623

Classroom experiments are a popular tool among economics instructors. A rich experimental literature studies their impact on student learning with between-subject designs that randomize classroom experiment use across course sections. Such designs are difficult to set up and conduct in a way that achieves adequate statistical power. We complement this literature with a within-subject experiment where classroom experiments are randomized across topics within a section, which enhances power and is easier to implement. We find little impact of our classroom experiments on student achievement for either male or female students, but these null results may mask heterogeneous effects across topics.

Journal of International Money and Finance--Volume 121, March 2023, 102791

We build and estimate a two-country structural macroeconomic model with meaningful household portfolio decisions over foreign and domestic bond holdings and financial intermediation to investigate the efficacy of large-scale asset purchases by a central bank. Financial intermediation between financial assets and the real economy means that asset purchases may not directly lead to increased real investment. Instead asset purchases result in an accumulation of deposit at banks without a corresponding rise in loans to the real economy. In contrast to conventional policy, positive effects of asset purchase primarily work through consumption and exports via changes in real exchange rates. When all countries engage in asset purchases, the effectiveness of the policy overall falls. Historical decomposition of US data reveals that unconventional monetary policies supported real economic activity when interest rates where zero (2009-2015), but not after. Although, their effect on financial markets remained significant through 2019.

Examining Business Cycles and Optimal Monetary Policy in a Regional DSGE Model

-Economic Modeling--Volume 136, July 2024, 106750

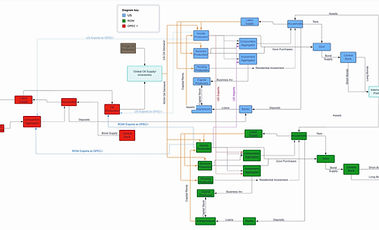

I construct a dynamic stochastic general equilibrium (DSGE) model consisting of geographic regions and use state level data to estimate the effects that monetary policy and financial shocks have on the four census regions of the United States. The DSGE model I use is constructed around a centralized monetary authority and financial market with regional output, labor and investment markets. I find significant heterogeneity amongst the regional structural parameters of the model, creating different business cycle dynamics for the four regions. The estimated model aligns with other economic studies that suggest that monetary shocks have a greater impact in certain geographic regions in terms of employment, inflation, wages, and consumption. Simulating the estimated model, I find that monetary policy that considers the regional variation in output and inflation can significantly lower the volatility around national output and inflation. The paper’s results suggest that regional macroeconomic conditions should be considered in monetary policy decisions.

The Building Blocks of Inflation: The role of monetary policy and the gap between goods and services

Journal of Economic Dynamics and Control--Volume 186, May 2026, 105298

I build and estimate a three-region structural macroeconomic model with a goods, services, housing and oil sector. The model also has meaningful household portfolio decisions over foreign and domestic bond holdings and financial intermediation to investigate the efficacy of large-scale asset purchases (LSAP) by a central bank. The model is built and estimated to ensure that the potential causes that have been pointed to as a reason for the global inflation seen in the COVID recovery economy are accounted for. Examining the dynamics of the model, LSAP’s conducted in an economy with relative high demand for goods rather than services will lead to a bigger expansionary and inflationary impact than in an economy where demand for services is relatively higher than goods. I also find that LSAP’s are more expansionary and inflationary when the service sector is incurring supply shocks. These findings help us understand why LSAPs conducted in the global financial crisis had such a different impact than those conducted in the COVID economy.

Working Papers/Projects

In the project we examine the inferences and forecasting benefits that can be made when one incorporates a large quantity of economic and financial time series into the Bank of Canada’s Terms-of-Trade Economic Model (bToTEM). We compare the fore- casting performance of four different structural models to forecasts generated by other benchmark reduced-form forecasting models. We find that an open-economy DSGE model estimated in a data-rich environment significantly outperforms its conventionally estimated DSGE counterpart for key macroeconomic growth variables of all horizons. We show that such enhanced forecasting performance can be attributed to the ad- ditional insights from the predicted effects of monetary policy on non-modeled series such as sectoral employment and wages, financial market data and credit supply. When bToTEM is estimated in a data-rich environment the superior forecasting results are maintained for all growth variables while also significantly lowering forecast error for inflation and nominal wage predictions compared to its regularly estimated bToTEM counterpart and other benchmark reduced-form forecasts models. In the context of Canada, we credit the forecasting improvement in the bToTEM-DFM model to the explicit modeling of the commodity sector and richer price and wage setting dynamics. In summary, we provide analysis to identify the roles of various modeling frictions vs the use of large amount of data sets have in driving these difference in forecasting performance for both real and nominal variables.

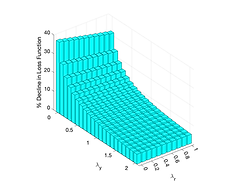

Considering the State of the World when conducting Real-Time Optimal Pool (RTOP) Model Weighting

I compare the out-of-sample forecasting performance of the two Dynamic Stochastic General Equilibrium (DSGE) models outlined in Gelfer (2019) when they are estimated both out of and in a data-rich environment. I find that the DSGE model with a financial accelerator out forecasts the model without financial frictions in only two periods over the first decade of the 21st century. I also find that the DGSE models estimated in a data rich environment (DSGE-DFM) significantly out forecast their regularly estimated counterpart in regard to output, consumption, and investment growth. In the second half of the paper I evaluate the out-of-sample forecasting performance of these four models against that of other forecasting models including VAR models, dynamic factor models, and structural FAVAR models. Additionally, I explore the “value” of model averaging DSGE-DFM models in terms of forecasting performance and I find that accounting for what type of micro-finance data is currently most volatile in real-time optimal pool model weighting procedures, produces the best out-of-sample forecasts for the entire forecast window (1999-2013) for all core macroeconomic production variables and inflation.